When it comes to New Year's resolutions, things like health and fitness and relationships can be obvious places to start. Yet saving, budgeting, and investing your money can be just as important. Humans are great at mortgaging the future to pay for the present, but one day the future come to cash in, and we'll want to be ready. Here are the best iPhone apps to help you take control of your personal finances in the New Year!

Level Money

Information may be power, but information requires awareness. Getting a handle on your money means knowing how much money you have, all the time. That's where Level Money comes in. Hook it up to your bank account and it simply, delightfully shows you what your funds are at any given time. That way you know what you can spend... and how much you can't.

- Free - Download now

Mint Bills & Money

Keeping track of bills can be stressful. Failing to keep track of them can be even more stressful. That's where Mint Bills & Money — formerly known as Check — comes in. It will let you know when your bills are due, by email and/or push notifications, and you can pay them straight from the app. Paying via bank account is free, but there's a minor fee for paying via credit or debit (which you should really avoid).

- Free - Download now

BUDGT

Once you know how much money you have, you can figure out how you want to spend it and how you want to save it. BUDGT makes that simple and easy. You can set your budget for all the different categories you want to use, track your expenses as they come in, and BUDGT shows you how you're doing so you can adjust as things come up. In other words, it helps you help yourself to financial sanity.

$1.99 - Download now

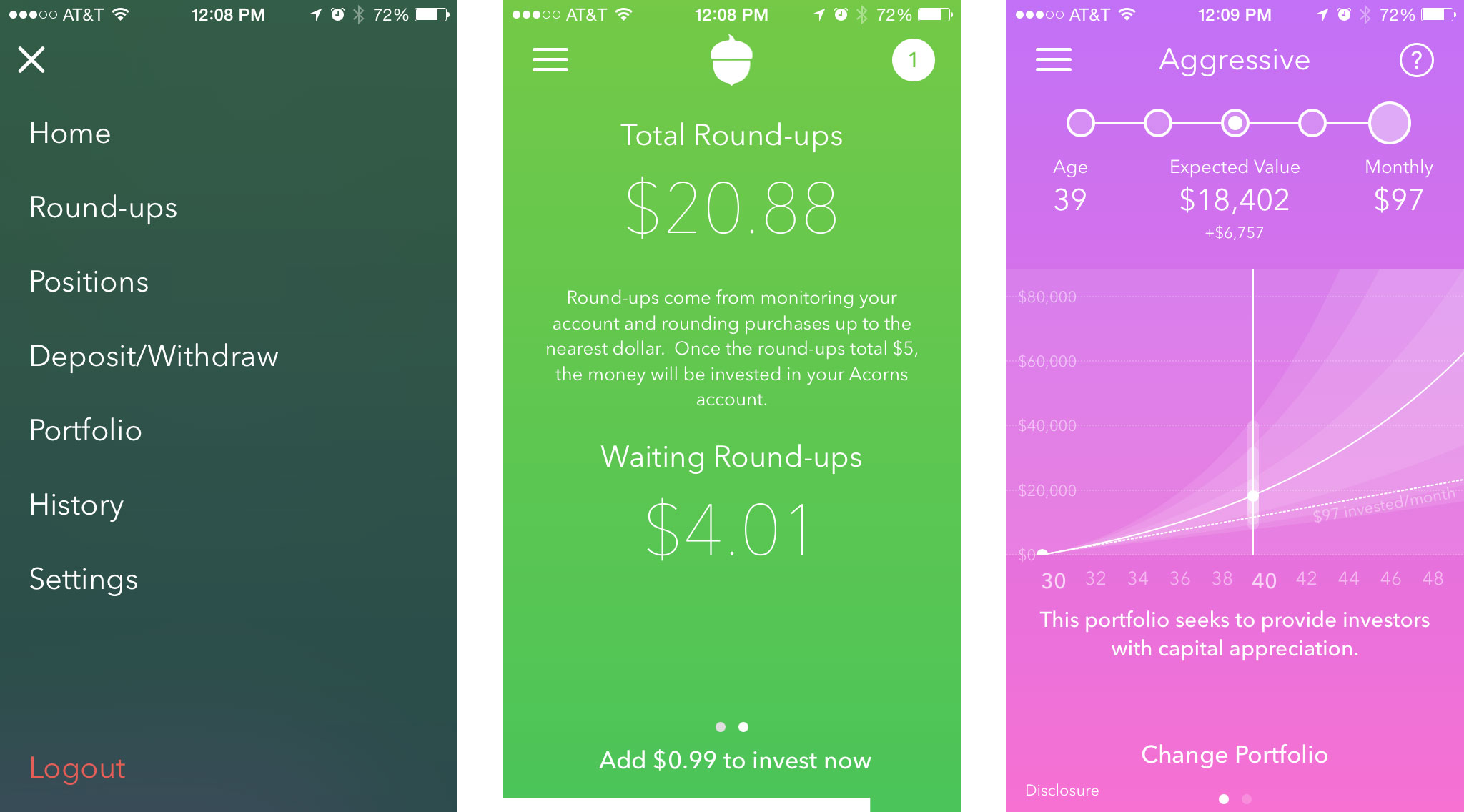

Acorns

Saving money is hard. That tempting purchase today always looks so much more gratifying than that investment payoff tomorrow. Acorns helps with that. It lets you link your credit and debit charge and then collects all the "spare change" left over from your every day purchases, combines them together, and then invests it a professionally managed portfolio. There are six different options, and you can choose how aggressive you want to be. All for a small fee.

- Free + fee - Download now

Your bank's app

If your bank has an app and you don't use it, consider using it. Many banks now have apps, and many of those have implemented things like Touch ID to make them both secure and convenient. With your bank's app, you can check your balance, pay your bills, check on your mortgage, investments, credit cards and lines, and any and all other financial services you may be using, if they're available to you. It's a great way to just make sure everything is where it's supposed to be, and that lets you relax get on with what you're supposed to be doing.

- Search the App Store for the name of your bank

Your favorite personal finance app?

Whether you've been using personal finance apps for a long time now, or are using New Year's as an excuse to get started, let me know which apps you like and why you like them!

No comments:

Post a Comment